In this article, I have reviewed some of the best photo editing software available on various Linux distributions. These are not the only photo editors available but are among the most popular and commonly used by Linux users.

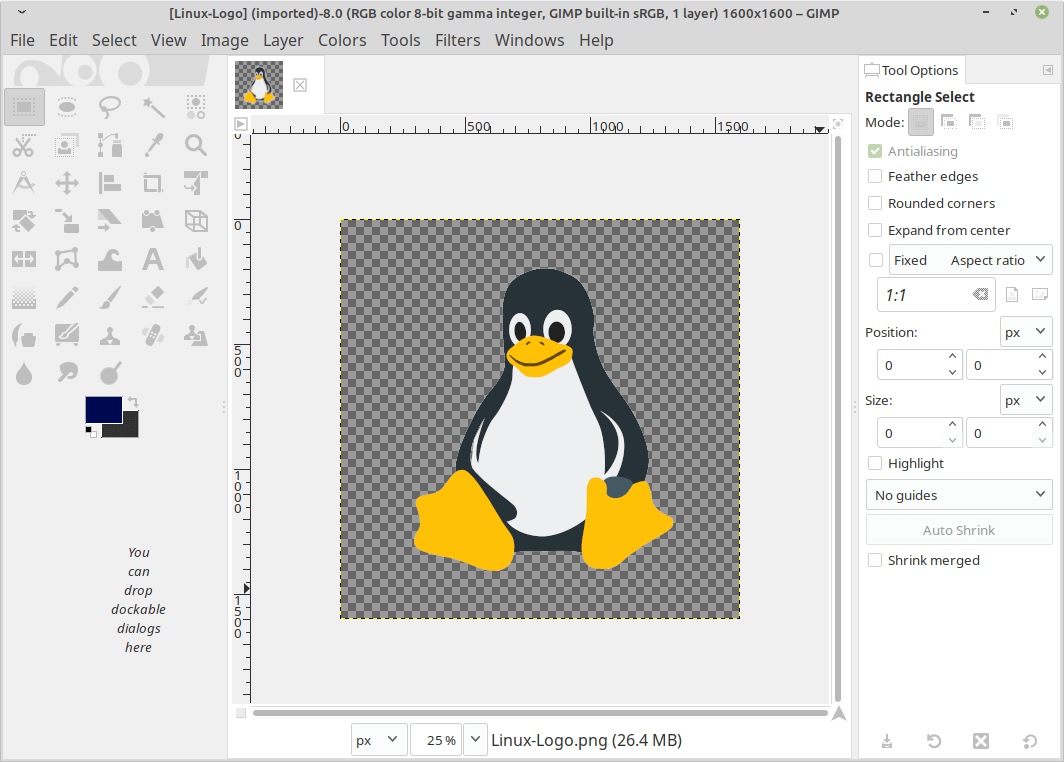

1. GIMP

First, on the list, we have GIMP, a free, open-source, cross-platform, extensible, and flexible image editor that works on GNU/Linux, Windows, OSX, and many other operating systems.

It provides sophisticated tools to get your job done, and it is built for graphic designers, photographers, illustrators, or scientists. It is also extensible and customizable via third-party plugins.

It features tools for high-quality image manipulation, image transformation, and the creation of graphic design elements. For programmers, GIMP is a high-quality framework for scripted image manipulation, it supports many languages including C, C++, Perl, Python, and Scheme.

To install GIMP on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install gimp [On Debian, Ubuntu and Mint] sudo yum install gimp [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/gimp [On Gentoo Linux] sudo apk add gimp [On Alpine Linux] sudo pacman -S gimp [On Arch Linux] sudo zypper install gimp [On OpenSUSE]

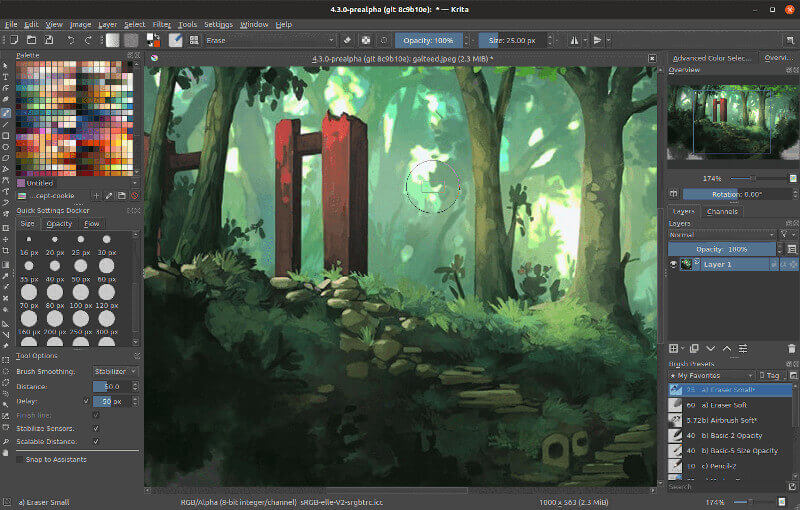

2. Krita

Krita, is a professional, creative, free, open-source, and cross-platform painting software and graphics editor for digital art and animation, compatible with Linux, Windows, and macOS.

Built by artists who want to see affordable art tools for everyone, it comes with tools you need for your work, usable via a clean, flexible, and intuitive user interface. It can be used for concept art, texture and matte painters, and illustrations, and comics.

To install Krita on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install Krita [On Debian, Ubuntu and Mint] sudo yum install Krita [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/Krita [On Gentoo Linux] sudo apk add Krita [On Alpine Linux] sudo pacman -S Krita [On Arch Linux] sudo zypper install Krita [On OpenSUSE]

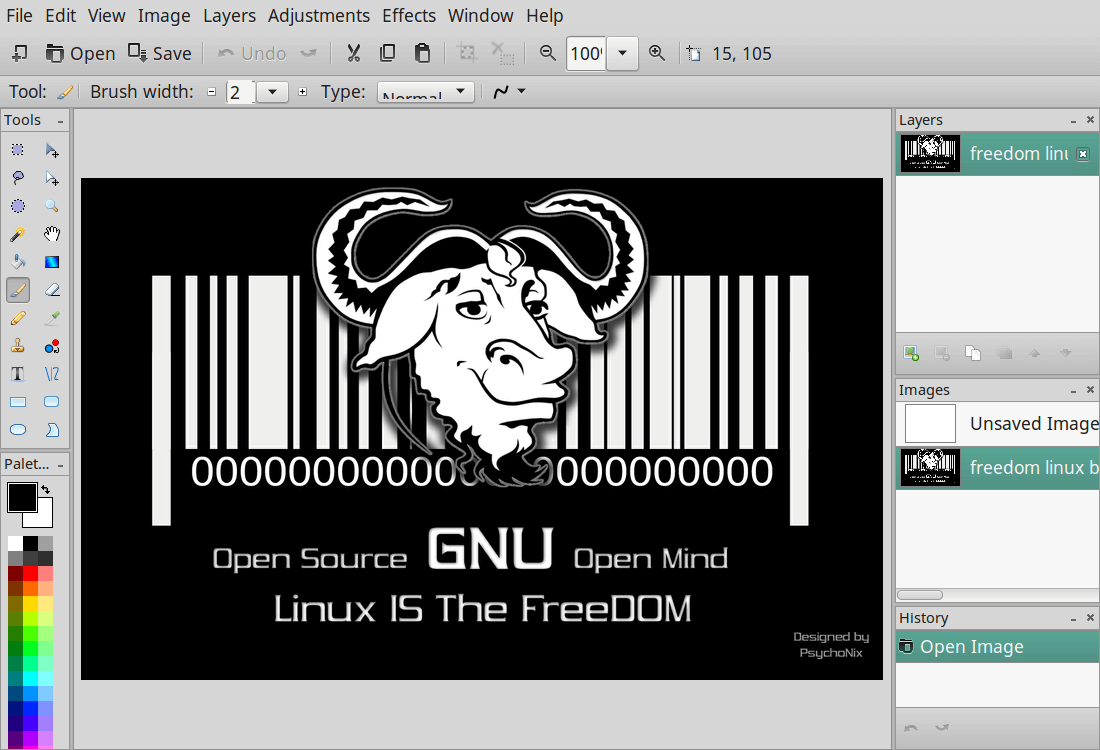

3. Pinta

Pinta is also an excellent photo editing application that functions similarly to Windows Paint.NET. You can think of it as the Linux counterpart to Windows Paint. It is simple and user-friendly, making it easy for users to perform quick photo edits.

To install Pinta on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install pinta [On Debian, Ubuntu and Mint] sudo yum install pinta [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/pinta [On Gentoo Linux] sudo apk add pinta [On Alpine Linux] sudo pacman -S pinta [On Arch Linux] sudo zypper install pinta [On OpenSUSE]

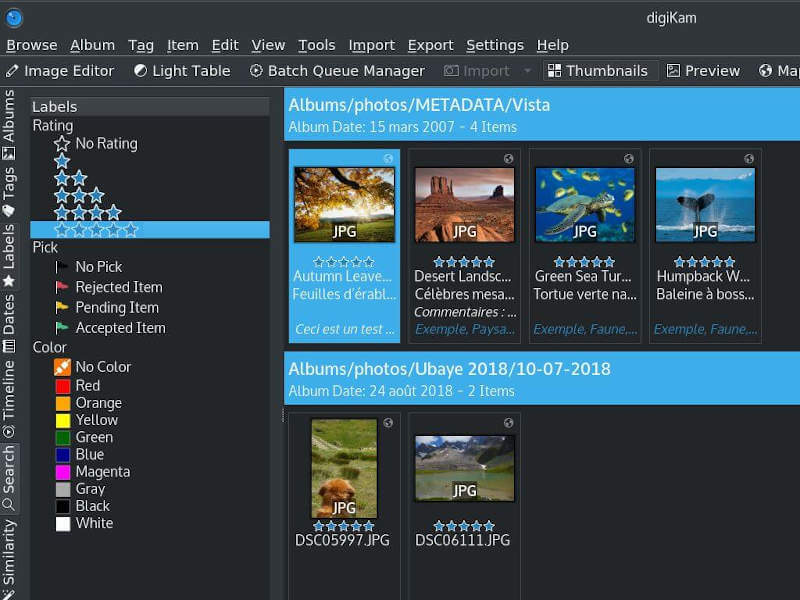

4. DigiKam

DigiKam is an advanced and professional, free open-source digital photo management application that runs on Linux, Windows, and macOS. It offers a toolset for importing, managing, editing, and sharing photos and raw files.

It has the following features:

- directory for tutorials on how to use it.

- facial recognition support.

- easy photo importing and exporting to different formats.

To install DigiKam on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install digikam [On Debian, Ubuntu and Mint] sudo yum install digikam [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/digikam [On Gentoo Linux] sudo apk add digikam [On Alpine Linux] sudo pacman -S digikam [On Arch Linux] sudo zypper install digikam [On OpenSUSE]

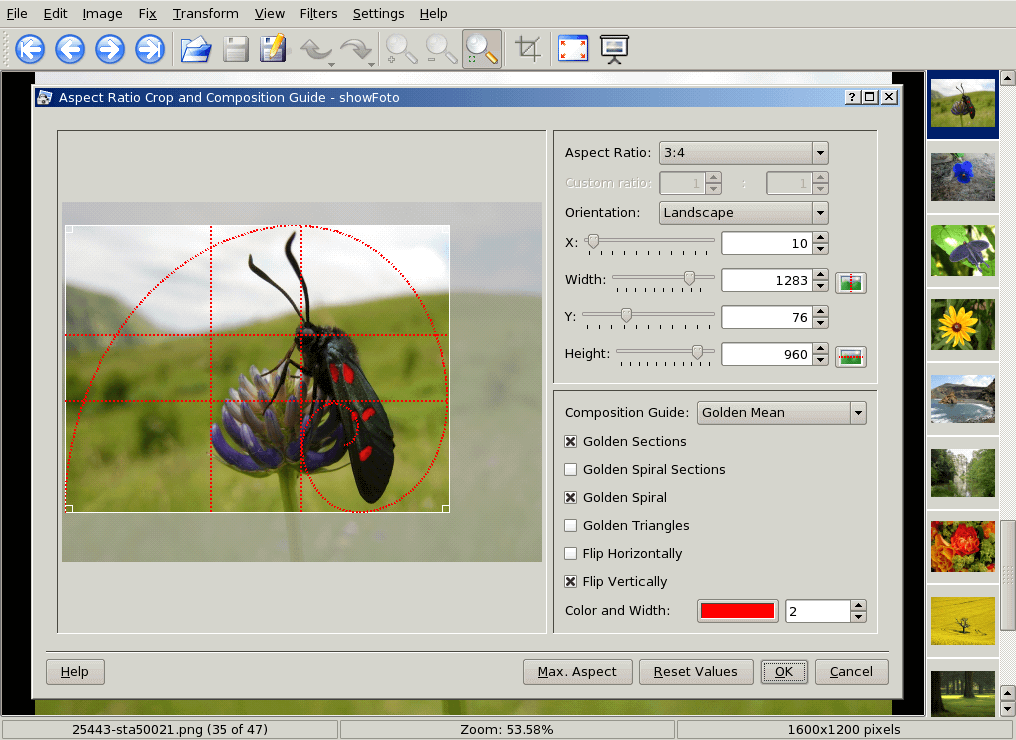

5. ShowFOTO

ShowFOTO is a standalone image editor under the digiKam project that is free and comes with all the standard photo editing functionalists such as transformation, adding effects, filtering, metadata editing, and many more.

It is lightweight and not feature-rich though it is a good image editing software that doesn’t require other software to run.

To install ShowFOTO on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install showfoto [On Debian, Ubuntu and Mint] sudo yum install showfoto [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/showfoto [On Gentoo Linux] sudo apk add showfoto [On Alpine Linux] sudo pacman -S showfoto [On Arch Linux] sudo zypper install showfoto [On OpenSUSE]

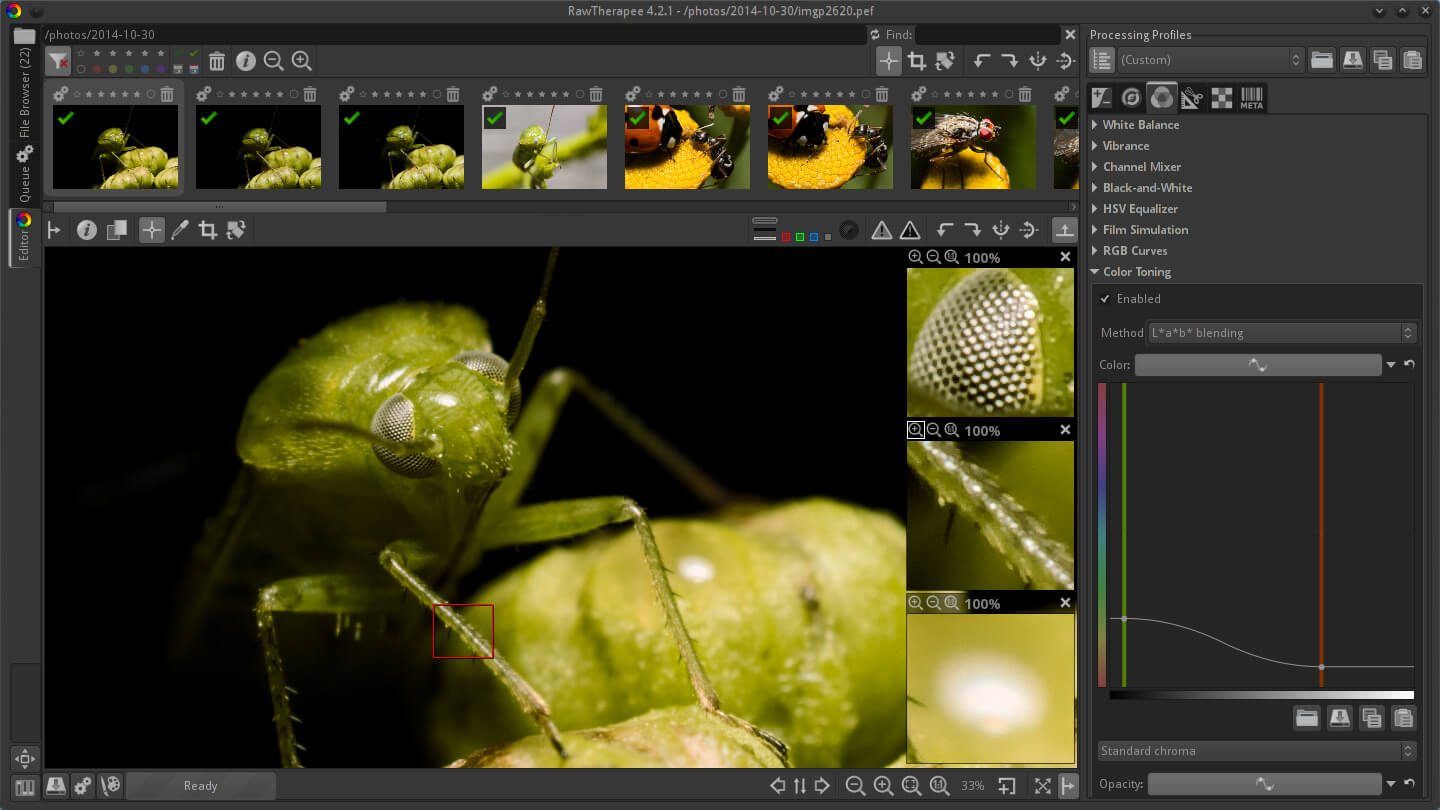

6. RawTherapee

RawTherapee is a free and open-source photo editor for optimizing digital images. It is feature-rich and powerful when you need quality digital images from RAW image files. RAW files can be modified and then saved in compressed formats as well.

It has many features as listed on the project homepage including:

- variety of supported cameras

- exposure control

- parallel editing

- color adjustment

- the option of using a secondary display

- metadata editing and many more

To install RawTherapee on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install rawtherapee [On Debian, Ubuntu and Mint] sudo yum install rawtherapee [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/rawtherapee [On Gentoo Linux] sudo apk add rawtherapee [On Alpine Linux] sudo pacman -S rawtherapee [On Arch Linux] sudo zypper install rawtherapee [On OpenSUSE]

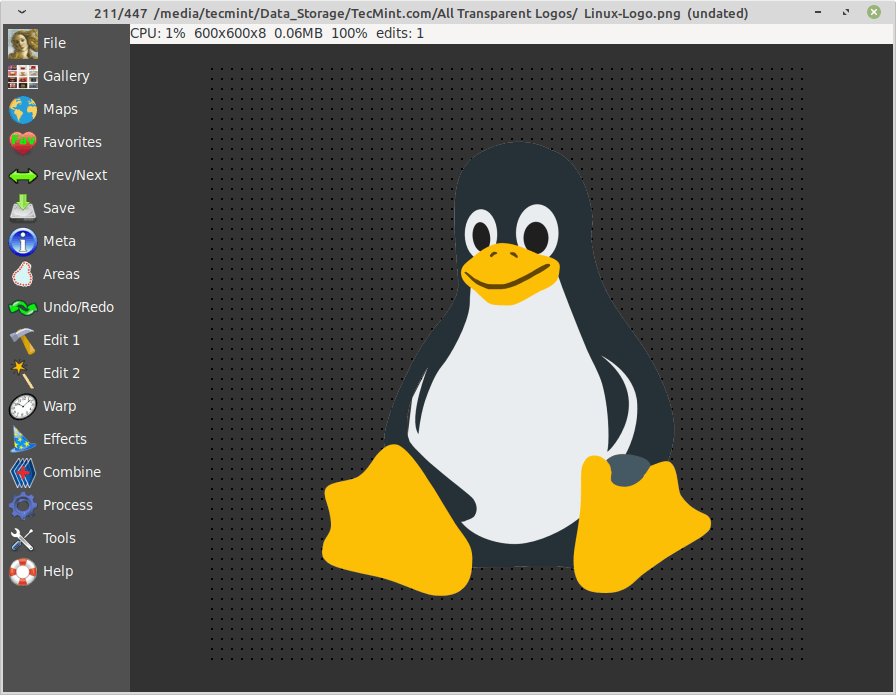

7. Fotoxx

Fotoxx is also a free and open-source photo editing and collection management tool. It is intended for dedicated photographers who need a simple, fast, and easy tool for photo editing.

It offers photo collection management and an easy way to navigate through the collection directories and subdirectories using a thumbnail browser.

It has the following features:

- use simple clicks to transform photos

- ability to retouch photos in enormous amounts of ways

- artistic photo transformation such as animations

- access to work with meta-data and many more

To install Fotoxx on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install fotoxx [On Debian, Ubuntu and Mint] sudo yum install fotoxx [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/fotoxx [On Gentoo Linux] sudo apk add fotoxx [On Alpine Linux] sudo pacman -S fotoxx [On Arch Linux] sudo zypper install fotoxx [On OpenSUSE]

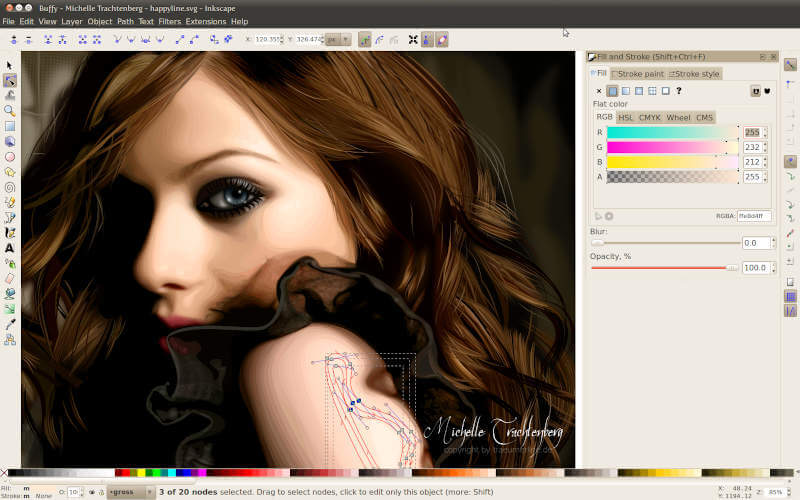

8. Inkscape

Inkscape is a free and open-source, cross-platform, feature-rich vector graphics editor that works on GNU/Linux, Windows, and macOS X. It is similar to Adobe Illustrator and it is widely used for both artistic and technical illustrations such as cartoons, clip art, logos, typography, diagramming, and flowcharting.

It features a simple interface, import, and export various file formats, including SVG, AI, EPS, PDF, PS, and PNG, and multi-lingual support. Additionally, Inkscape is designed to be extensible with add-ons.

To install Inkscape on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install inkscape [On Debian, Ubuntu and Mint] sudo yum install inkscape [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/inkscape [On Gentoo Linux] sudo apk add inkscape [On Alpine Linux] sudo pacman -S inkscape [On Arch Linux] sudo zypper install inkscape [On OpenSUSE]

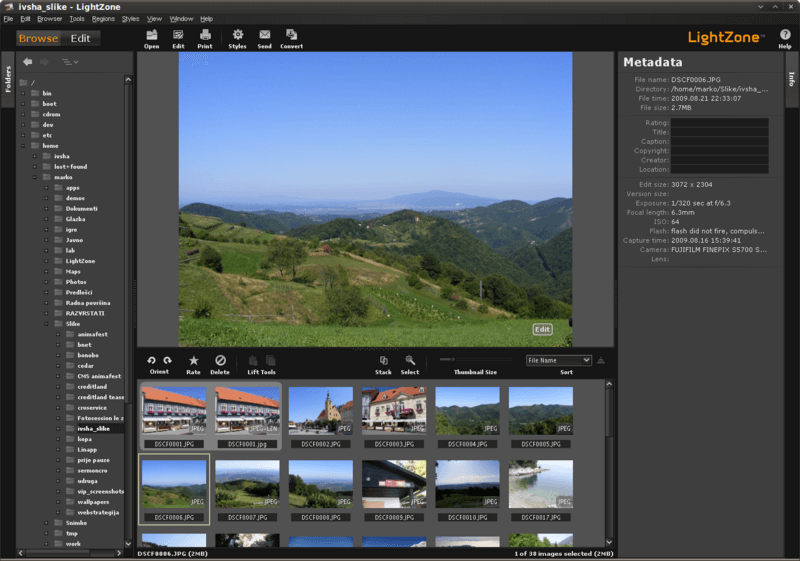

9. LightZone

LightZone is an open-source, professional-grade digital darkroom software for Linux, Windows, and Mac OS X, that supports RAW processing and editing.

Unlike other photo editors that use layers, LightZone enables you to build up a stack of tools that can be rearranged, readjusted, turned off and on, and removed from the stack at any time.

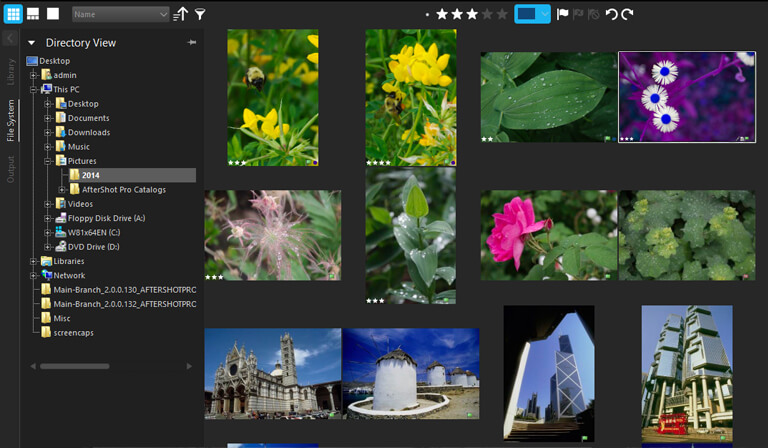

10. AfterShot Pro

AfterShot is a commercial and proprietary, cross-platform RAW image processing application that is simple yet powerful. For beginners, it lets you quickly learn professional-grade photo editing by making it easy to make corrections and enhancements and apply adjustments to one or thousands of photos at once with batch processing tools.

It features simple photo management, ultra-fast workflow, powerful batch processing, and so much more. Importantly, AfterShot Pro integrates well with Photoshop(you can send photos to Photoshop with just a click on a button).

11. Darktable

Darktable is an open-source and powerful photography workflow application and raw developer, built for photographers, by photographers. It is a virtual lighttable and darkroom for managing your digital negatives in a database and lets you view them through a zoomable lighttable and enables you to develop raw images and enhance them.

With Darktable, all editing is fully non-destructive and only operates on cached image buffers for display, and the full image is only converted during export. Its internal architecture allows you to easily plugin modules of all kinds to improve its default functionality.

To install Darktable on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install darktable [On Debian, Ubuntu and Mint] sudo yum install darktable [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/darktable [On Gentoo Linux] sudo apk add darktable [On Alpine Linux] sudo pacman -S darktable [On Arch Linux] sudo zypper install darktable [On OpenSUSE]

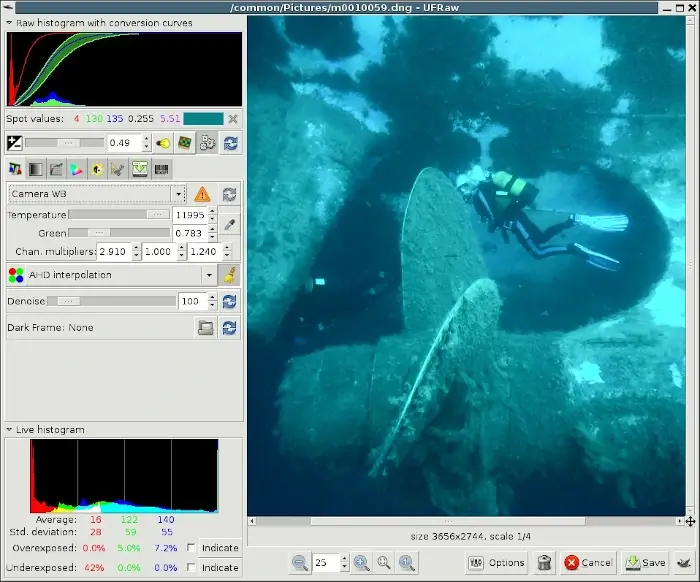

12. UFRaw

UFRaw (Unidentified Flying Raw) is an open-source software designed for processing and editing raw image files captured by digital cameras. It serves as a valuable tool for photographers and image enthusiasts, offering a wide range of features for enhancing and manipulating raw photos.

UFRaw provides support for various camera models and their respective raw file formats, making it versatile for different photography setups.

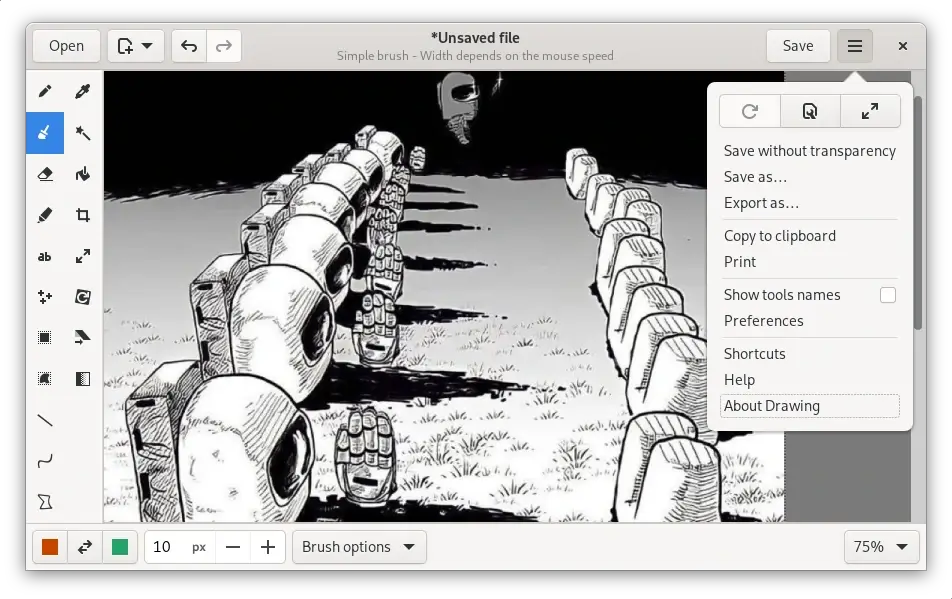

13. Drawing

Drawing is a simple free image editor that allows you to resize, crop, or rotate an image, apply filters, insert or censor text, and alter a chosen portion of the picture through cut, copy, paste, and drag opertions.

Moreover, it provides drawing capabilities with tools such as the pencil, straight line, curve tool, various shapes, several brushes, and a range of colors and options. It also supports file types including PNG, JPEG, and BMP.

To install Drawing on Linux, use the following appropriate command for your specific Linux distribution.

sudo apt install drawing [On Debian, Ubuntu and Mint] sudo yum install drawing [On RHEL/CentOS/Fedora and Rocky/AlmaLinux] sudo emerge -a sys-apps/drawing [On Gentoo Linux] sudo apk add drawing [On Alpine Linux] sudo pacman -S drawing [On Arch Linux] sudo zypper install drawing [On OpenSUSE]

Conclusion

Thanks for reading and hope you find this article useful, if you know of other good photo editors available in Linux, let us know by leaving a comment. Stay connected to Tecmint for more quality articles.

Thank you for featuring software tailored for artistic photo editing and retouching on Linux! GIMP and Krita have been instrumental in my creative projects, offering an array of advanced features and customization options.

Your article provides a valuable resource for Linux users seeking to enhance their images with professional-grade tools. I’m excited to explore the possibilities further with these fantastic tools!

Try ImageMagick, which is REALLY powerful and great at automation but it is a commandline tool only. I imagine a lot of the programs use IM as their backends.

AfterShot Pro? How old is the Linux distribution, where was the installation?

@Robert,

I recently tested AfterShot Pro on Ubuntu 22.04, and the performance was quite impressive.

Thanks, no installation is possible under Debian. I think this will be a Docker project :)

Check out GNOME’s “Drawing” image editor – a very simple app.

@Puppy,

Thank you for the suggestion! I’ll definitely check out GNOME’s “Drawing” image editor. It sounds like a simple and useful app.

I want something that has the same range of tools and filters for image editing that Fotor has. Gimp just doesn’t have the same range, it’s actually quite limited to basic colors. Starting to get frustrated.

Number 3 on the list “Pinta” I installed, on my distribution, added almost 200 “Trust Certs” for various websites. A very sly way to infiltrate a Linux OS browser.

I installed them from the command prompt or I would never have noticed them. I have no issue with the software or developer, but this will be reported to the distribution center.

Gimp is fine, but I really feel it became bloated after version 1.6, Inkscape is less about images and more about vector graphics. If you want to learn a good editor on this list, Krita is the best one.

Hi,

I’m new to linux and the only windows program I miss is faststone, which is simple and got the job done in no time. Is there anything on linux that’s even close?? most of the programs do a lot more than I need to.

I know how to use a camera so what I usually want will be in the frame, no need to do all that much to it, maybe a little bit of color or gamma or contrast but pretty minimal. Cropping too perhaps and flippin’ left right or over or resizing once in a while, but that about covers it mostly.

Something simple and intuitive like faststone worked perfectly for that. I wish they made a version for linux too, but they don’t. Any similar tool in Linux?

Thanks a bunch…

Frenchy

Most of these programs are not image editors.

Pixeluvo is not available for Linux.

Photoshop is for Windows and Mac, but not Linux.

Photoshop is the best software to use when it comes to photo editing.

Photoshop is my favorite software for photo editing.

The Pinta that your mentioned helped me. Thanks!

I am new to Linux. After trying several distros, I am now using KDE Neon Plasma.

I need a utility to do batch job editing. I am using now Conversed, but it is confusing.

Any other options?

Thanks

I professionally use GIMP for a long time. Never use Krita. Look promising to me.

Many thanks for this useful article…

It’s Inkscape, not inkscace… Thanks for the list.

Inkspace is a proprietary Wacom tool, nothing to do with Inkscape.

@Lug68,

Thanks, corrected in the article…

Thanks, I chose Pinta.

@Arunlal

Many thanks for the feedback.

What RAW converter/software can work with the RAW files from a Canon 5Ds? Darktable and UFO cannot .

@Svein

Try UFRaw for working with the RAW files.

Sorry, I wrote UFO, but I meant UFRaw. It don’t read the Canon 5Ds CR2 Raw files. So I just bought the Corel Aftershot Pro 3 which does.

@Svein

Okay, well, thanks for the feedback.

Darktable can load 5Ds Raws !!! try a newer version

After reading this I personally love to use GIMP and this is on of my favorite editor application.

@Aashirvad

Me too, i got stuck with GIMP and it’s really popular. We use it extensively here at Tecmint. Many thanks for the feedback.

Please help me find something that works for Linux for auto-fix like this photolemur.com/how-it-works? I am impressed with these apps but they are also freaking me out. It takes so LONG to actually do something simple, I end up not editing at all. Are there easy quick automatic photo improvement apps like Photolemur for android without all the “black magic”?

@Louise

You’ll realize that such features as this photolemur.com/how-it-works? come a certain cost, many of the Linux photo/image editing softwares out there are free and therefore you need to use a little effort to enhance images yourself most of the time. The auto-fix features in them may not work exactly like that of photolemur.com/how-it-works?, you’ll still need to do it manually.

GIMPshop another gimp with photoshop extension(CMIIW)

@Morteza, I’m pleased to report that Polarr is now available as a downloadable Linux client (64 bit only).

I am looking for a Photo Explosion replacement that will work on Ubuntu. Does anyone know of something.

@Dave

Have you tried any of the photo editors, such as Darktable, Photoshop Wine and the rest? Give them a try and see if they work similarly as Photo Explosion.

Polarr for chrome is a handly, lightweight and very good photo editor.

Thanks for sharing the valuable information. I have used DigiKam, Pinta, Photoshop & Photo pos PRO. I really liked them all. They are really helpful to quickly edit or enhance your photo. Moreover they lets you to have a complete control over your images, including layers and effects.

Recently installed Polarr on my Oneplus3 and found out there are desktop versions as well (standalone and in your browser). I downloaded the .deb version on Ubuntu Gnome. Works great! Free version is very usable but blocks a couple of effects and radial gradients. No buggy.

Thanks for the useful info, and also getting back to us. We shall give Polarr a try and probably add it to the list above.

Gimp is GOOD tool to edit photos.

It offers some great features but some users do not find it that interesting. But it comes in handy.

Gimp is NOT a good tool. Also you don’t have Krita (krita.org) listed, free and used by many hollywood pro’s for image editing.

@jeff

Whether Gimp is good or not good will depend on personal satisfaction. But thanks for sharing your thoughts, that is your own experience.

Pinta is a “buggy”, “broken” and formerly “abandoned” poorly coded and very poorly maintained Linux clone of Paint.net with numerous features that do not function properly. Is that what you meant by a Linux version of Microsoft Paint?

To be clear, I really hope that the good folks that picked that project out of the trash bin and did their best to get it back on track can get a little more help with it from others that might be a little more up to the task. Linux has always been in need of a simple image editing application such as that for those that just want something simple, that works.

@grey

Thanks for the info, i have to try it out

Pixeluvo 1.5

Download a 30 day trial version of Pixeluvo now. This also acts as the installer for the full version, simply enter your license details and enjoy Pixeluvo with no limitations.

Please note the trial version is limited to saving files no larger than 800×600 pixels.