Computers are connected in a network to exchange information or resources with each other. Two or more computers are connected through network media called a computer network. There is a number of network devices or media are involved to form a computer network.

Computer loaded with Linux Operating System can also be a part of network whether it is a small or large network by its multitasking and multiuser natures. Maintaining the system and network up and running is a task of the System / Network Administrator’s job.

[ You might also like: 22 Linux Networking Commands for Sysadmin ]

In this article, we are going to review frequently used network configuration and troubleshoot commands in Linux.

1. ifconfig Command

ifconfig (interface configurator) command is used to initialize an interface, assign IP Address to interface and enable or disable interface on demand.

With this command, you can view IP Address and Hardware / MAC address assign to interface and also MTU (Maximum transmission unit) size.

# ifconfig

eth0 Link encap:Ethernet HWaddr 00:0C:29:28:FD:4C

inet addr:192.168.50.2 Bcast:192.168.50.255 Mask:255.255.255.0

inet6 addr: fe80::20c:29ff:fe28:fd4c/64 Scope:Link

UP BROADCAST RUNNING MULTICAST MTU:1500 Metric:1

RX packets:6093 errors:0 dropped:0 overruns:0 frame:0

TX packets:4824 errors:0 dropped:0 overruns:0 carrier:0

collisions:0 txqueuelen:1000

RX bytes:6125302 (5.8 MiB) TX bytes:536966 (524.3 KiB)

Interrupt:18 Base address:0x2000

lo Link encap:Local Loopback

inet addr:127.0.0.1 Mask:255.0.0.0

inet6 addr: ::1/128 Scope:Host

UP LOOPBACK RUNNING MTU:16436 Metric:1

RX packets:8 errors:0 dropped:0 overruns:0 frame:0

TX packets:8 errors:0 dropped:0 overruns:0 carrier:0

collisions:0 txqueuelen:0

RX bytes:480 (480.0 b) TX bytes:480 (480.0 b)

ifconfig with interface (eth0) command only shows specific interface details like IP Address, MAC Address, etc. with -a option will display all available interface details if it is disabled also.

# ifconfig eth0

eth0 Link encap:Ethernet HWaddr 00:0C:29:28:FD:4C

inet addr:192.168.50.2 Bcast:192.168.50.255 Mask:255.255.255.0

inet6 addr: fe80::20c:29ff:fe28:fd4c/64 Scope:Link

UP BROADCAST RUNNING MULTICAST MTU:1500 Metric:1

RX packets:6119 errors:0 dropped:0 overruns:0 frame:0

TX packets:4841 errors:0 dropped:0 overruns:0 carrier:0

collisions:0 txqueuelen:1000

RX bytes:6127464 (5.8 MiB) TX bytes:539648 (527.0 KiB)

Interrupt:18 Base address:0x2000

Set IP Address and Gateway in Linux

Assigning an IP Address and Gateway to the interface on the fly. The setting will be removed in case of a system reboot.

# ifconfig eth0 192.168.50.5 netmask 255.255.255.0

Enable or Disable Specific Interface

To enable or disable a specific Interface, we use the example command as follows.

Enable eth0

# ifup eth0

Disable eth0

# ifdown eth0

Setting MTU Size

By default MTU size is 1500. We can set the required MTU size with the below command. Replace XXXX with size.

# ifconfig eth0 mtu XXXX

Set Interface in Promiscuous Mode

The network interface only received packets belonging to that particular NIC. If you put the interface in the promiscuous mode it will receive all the packets. This is very useful to capture packets and analyze them later. For this, you may require superuser access.

# ifconfig eth0 - promisc

Update: The ifconfig command is replaced by the IP command in most modern Linux distributions.

2. Ping Command

Ping (Packet INternet Groper) command is the best way to test connectivity between two nodes. Whether it is Local Area Network (LAN) or Wide Area Network (WAN).

Ping uses ICMP (Internet Control Message Protocol) to communicate to other devices. You can ping hostname or ip address using the below commands.

# ping 4.2.2.2 PING 4.2.2.2 (4.2.2.2) 56(84) bytes of data. 64 bytes from 4.2.2.2: icmp_seq=1 ttl=44 time=203 ms 64 bytes from 4.2.2.2: icmp_seq=2 ttl=44 time=201 ms 64 bytes from 4.2.2.2: icmp_seq=3 ttl=44 time=201 ms OR # ping www.tecmint.com PING tecmint.com (50.116.66.136) 56(84) bytes of data. 64 bytes from 50.116.66.136: icmp_seq=1 ttl=47 time=284 ms 64 bytes from 50.116.66.136: icmp_seq=2 ttl=47 time=287 ms 64 bytes from 50.116.66.136: icmp_seq=3 ttl=47 time=285 ms

In the Linux ping command keep executing until you interrupt. Ping with -c option exit after N number of requests (success or error respond).

# ping -c 5 www.tecmint.com PING tecmint.com (50.116.66.136) 56(84) bytes of data. 64 bytes from 50.116.66.136: icmp_seq=1 ttl=47 time=285 ms 64 bytes from 50.116.66.136: icmp_seq=2 ttl=47 time=285 ms 64 bytes from 50.116.66.136: icmp_seq=3 ttl=47 time=285 ms 64 bytes from 50.116.66.136: icmp_seq=4 ttl=47 time=285 ms 64 bytes from 50.116.66.136: icmp_seq=5 ttl=47 time=285 ms --- tecmint.com ping statistics --- 5 packets transmitted, 5 received, 0% packet loss, time 4295ms rtt min/avg/max/mdev = 285.062/285.324/285.406/0.599 ms

3. Traceroute Command

traceroute is a network troubleshooting utility that shows the number of hops taken to reach a destination also determines packets traveling path. Below we are tracing the route to the global DNS server IP Address and able to reach destination also shows the path of that packet is traveling.

# traceroute 4.2.2.2 traceroute to 4.2.2.2 (4.2.2.2), 30 hops max, 60 byte packets 1 192.168.50.1 (192.168.50.1) 0.217 ms 0.624 ms 0.133 ms 2 227.18.106.27.mysipl.com (27.106.18.227) 2.343 ms 1.910 ms 1.799 ms 3 221-231-119-111.mysipl.com (111.119.231.221) 4.334 ms 4.001 ms 5.619 ms 4 10.0.0.5 (10.0.0.5) 5.386 ms 6.490 ms 6.224 ms 5 gi0-0-0.dgw1.bom2.pacific.net.in (203.123.129.25) 7.798 ms 7.614 ms 7.378 ms 6 115.113.165.49.static-mumbai.vsnl.net.in (115.113.165.49) 10.852 ms 5.389 ms 4.322 ms 7 ix-0-100.tcore1.MLV-Mumbai.as6453.net (180.87.38.5) 5.836 ms 5.590 ms 5.503 ms 8 if-9-5.tcore1.WYN-Marseille.as6453.net (80.231.217.17) 216.909 ms 198.864 ms 201.737 ms 9 if-2-2.tcore2.WYN-Marseille.as6453.net (80.231.217.2) 203.305 ms 203.141 ms 202.888 ms 10 if-5-2.tcore1.WV6-Madrid.as6453.net (80.231.200.6) 200.552 ms 202.463 ms 202.222 ms 11 if-8-2.tcore2.SV8-Highbridge.as6453.net (80.231.91.26) 205.446 ms 215.885 ms 202.867 ms 12 if-2-2.tcore1.SV8-Highbridge.as6453.net (80.231.139.2) 202.675 ms 201.540 ms 203.972 ms 13 if-6-2.tcore1.NJY-Newark.as6453.net (80.231.138.18) 203.732 ms 203.496 ms 202.951 ms 14 if-2-2.tcore2.NJY-Newark.as6453.net (66.198.70.2) 203.858 ms 203.373 ms 203.208 ms 15 66.198.111.26 (66.198.111.26) 201.093 ms 63.243.128.25 (63.243.128.25) 206.597 ms 66.198.111.26 (66.198.111.26) 204.178 ms 16 ae9.edge1.NewYork.Level3.net (4.68.62.185) 205.960 ms 205.740 ms 205.487 ms 17 vlan51.ebr1.NewYork2.Level3.net (4.69.138.222) 203.867 ms vlan52.ebr2.NewYork2.Level3.net (4.69.138.254) 202.850 ms vlan51.ebr1.NewYork2.Level3.net (4.69.138.222) 202.351 ms 18 ae-6-6.ebr2.NewYork1.Level3.net (4.69.141.21) 201.771 ms 201.185 ms 201.120 ms 19 ae-81-81.csw3.NewYork1.Level3.net (4.69.134.74) 202.407 ms 201.479 ms ae-92-92.csw4.NewYork1.Level3.net (4.69.148.46) 208.145 ms 20 ae-2-70.edge2.NewYork1.Level3.net (4.69.155.80) 200.572 ms ae-4-90.edge2.NewYork1.Level3.net (4.69.155.208) 200.402 ms ae-1-60.edge2.NewYork1.Level3.net (4.69.155.16) 203.573 ms 21 b.resolvers.Level3.net (4.2.2.2) 199.725 ms 199.190 ms 202.488 ms

4. Netstat Command

Netstat (Network Statistic) command displays connection info, routing table information, etc. To display routing table information use option as -r.

# netstat -r Kernel IP routing table Destination Gateway Genmask Flags MSS Window irtt Iface 192.168.50.0 * 255.255.255.0 U 0 0 0 eth0 link-local * 255.255.0.0 U 0 0 0 eth0 default 192.168.50.1 0.0.0.0 UG 0 0 0 eth0

For more examples of Netstat Command, please read our earlier article on 20 Netstat Command Examples in Linux.

Update: The netstat command is replaced by the ss (socket statistics) command in most modern Linux distributions.

5. Dig Command

Dig (domain information groper) query DNS related information like A Record, CNAME, MX Record, etc. This command is mainly used to troubleshoot DNS-related queries.

# dig www.tecmint.com; <<>> DiG 9.8.2rc1-RedHat-9.8.2-0.10.rc1.el6 <<>> www.tecmint.com ;; global options: +cmd ;; Got answer: ;; ->>HEADER<

For more examples of Dig Command, please read the article on 10 Linux Dig Commands to Query DNS.

6. Nslookup Command

nslookup command is also used to find out DNS-related queries. The following examples show A Record (IP Address) of tecmint.com.

# nslookup www.tecmint.com Server: 4.2.2.2 Address: 4.2.2.2#53 Non-authoritative answer: www.tecmint.com canonical name = tecmint.com. Name: tecmint.com Address: 50.116.66.136

For more Nslookup Command, read the article on 8 Linux Nslookup Command Examples.

7. Route Command

route command also shows and manipulates the ip routing table. To see the default routing table in Linux, type the following command.

# route Kernel IP routing table Destination Gateway Genmask Flags Metric Ref Use Iface 192.168.50.0 * 255.255.255.0 U 0 0 0 eth0 link-local * 255.255.0.0 U 1002 0 0 eth0 default 192.168.50.1 0.0.0.0 UG 0 0 0 eth0

Adding, deleting routes and default Gateway with following commands.

Add Route in Linux

# route add -net 10.10.10.0/24 gw 192.168.0.1

Delete Route in Linux

# route del -net 10.10.10.0/24 gw 192.168.0.1

Add Default Gateway in Linux

# route add default gw 192.168.0.1

8. Host Command

host command to find a name to IP or IP to name in IPv4 or IPv6 and also query DNS records.

# host www.google.com www.google.com has address 173.194.38.180 www.google.com has address 173.194.38.176 www.google.com has address 173.194.38.177 www.google.com has address 173.194.38.178 www.google.com has address 173.194.38.179 www.google.com has IPv6 address 2404:6800:4003:802::1014

Using -t an option to find out DNS Resource Records like CNAME, NS, MX, SOA, etc.

# host -t CNAME www.redhat.com www.redhat.com is an alias for wildcard.redhat.com.edgekey.net.

9. Arp Command

ARP (Address Resolution Protocol) is useful to view/add the contents of the kernel’s ARP tables. To see the default table use the command as.

# arp -e Address HWtype HWaddress Flags Mask Iface 192.168.50.1 ether 00:50:56:c0:00:08 C eth0

10. Ethtool Command

ethtool is a replacement for mii-tool. It is to view, setting speed and duplex of your Network Interface Card (NIC). You can set duplex permanently in /etc/sysconfig/network-scripts/ifcfg-eth0 with ETHTOOL_OPTS variable.

# ethtool eth0

Settings for eth0:

Current message level: 0x00000007 (7)

Link detected: yes

11. Iwconfig Command

iwconfig command in Linux is used to configure a wireless network interface. You can see and set the basic Wi-Fi details like SSID channel and encryption. You can refer man page of iwconfig to know more.

# iwconfig [interface]

12. Hostname Command

The hostname is to identify in a network. Execute the hostname command to see the hostname of your box. You can set hostname permanently in /etc/sysconfig/network. Need to reboot box once set a proper hostname.

# hostname tecmint.com

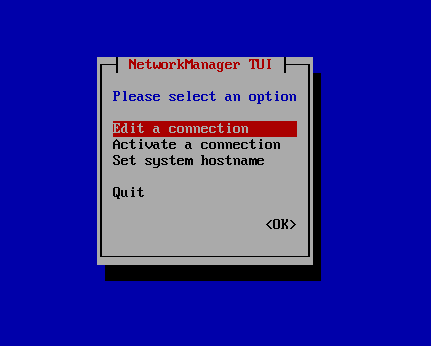

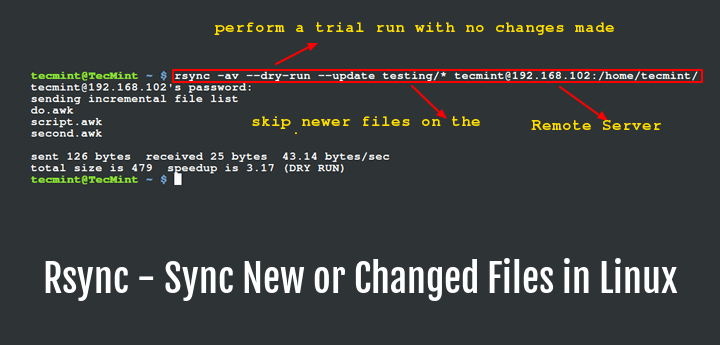

13. Nmcli and Nmtui Tools

The Nmcli and Nmtui tools are used to configure network settings and also used to manage network devices, create, modify, activate/deactivate, and delete network connections in Linux systems.

# nmcli # nmtui

This article can be useful for day to day use of Linux Network administrators in Linux / Unix-like operating systems. Kindly share through our comment box if we missed out.

Why does the Tecmint staff insist on prefixing all their sample command in all their articles with a hash mark

(#)? Commands written in this way will be treated as comments by the Linux Operating System and never be executed.@Dragonmouth,

Thank you for your comment. The Tecmint staff may prefix sample commands with a hash mark

(#)to indicate that they are meant to be run as root or with elevated privileges. This is a common convention in Linux documentation and tutorials.Hi,

Thanks a lot, very useful article.

dns is replying fine but internet is not working in Ubuntu.

Easy fix, is your ping responding? if not check with the command “route -n” and make sure your gateways are lining up. If not type the command (With your IP address of your router, my example is the basic 192.168.1.1… “route add default gw 192.168.1.1” Then check the internet once again.

system-config-network doesn’t work on my KDE Neon

This article is so out of date that it should be removed. In particular, use the ip command and use tracepath, not traceroute.

It is a bit out of date, sure, but these commands still work. traceroute is still usable, and pathping is ICMP, it is not the same underlying protocol as traceroute. It’s always easy to criticize. The author might not be an authoritative person for Linux administration, maybe just someone sharing their thoughts

@Peter,

It would be really helpful if you could tell us what needs to be updated in this article? so that we can update the article based on your suggestions…

Excellent list, all commands are very useful.

YOU ARE SO RIGHT

some command not working on kali

@Mir,

Could you tell us which commands not working on Kali?

this one system-config-network

you must be kali light version

give me full command list bro

I need information about “Write a short note on troubleshooting in Linux”

I have interview in linux I am fresher they ask me to prepare network commands.

Is this enough for that as you taught above!!!

@Santhosh,

First of all best of luck for your upcoming interview, for network related questions, I suggest you to go through netstat command, dig command, ip command, ifconfig command and the most recommend tool nmap command.

Thank you!!!

Its very useful

What would you recommend for a Certified Linux technician, with no experience on Linux OS. I would like to get more experience on useful commands and how to navigate in and out through network settings for servers.

@Moe,

I recommend you to first learn the basics of Linux (command and usage) and then dive into more advance level, it will help you to enhance your skills on Linux, Here is the complete noob guide for Linux, go through it as per their order and learn it on your own way….

https://www.tecmint.com/free-online-linux-learning-guide-for-beginners/

This is very very usefull

very useful

this is very usefull ,thanx

I would add tcpdump and wire shark for sniffing packets

Traceroute is good as well

Kernel bypass networking is increasing reputation. This depicts affecting organize of Ethernet hardware straight into user space procedures to evade the transparency of con-terminal with the operating system Kernel.

Are those tools used for system configuration?

@Mary,

Used for system network troubleshooting..

overall the content is good

will u please give the clear information regarding the nslookup command in linux

Thanks for the comprehensive definitions and examples.

Hi

if I set up a VPN to a server using Windows, I am able to ping to the server (192.168.1.1) AND to a desktop in the server network (i.e. 192.168.1.221). When I do the same under Linux I can ping to the server, but not anymore to the desktop linked to the server (i.e. 192.168.1.221).

Any suggestion what tool I could use to discover the problem?

Gert

if i use ndis wrapper to install my wireless driver in Centos 6.5 an i can’t find a record which identify my wireless driver and i can’t find a record in /etc/sysconfig/network-scripts which show me lo and eth0 only !!!!!!!!

i want to know what is the command for inseting data into existing file in anyware instead of vi editor

pls let me know

which is the program that contains the package “system-config-network” ??

what is the command in Linux to find traffic between to IPS … i.e Source IP and Destination IP

I believe ping is the “packet internet groper”, not “gopher” as indicated

Yeah that was typo, corrected in write up and thanks for informing us.

we are not able to ping the gateway ip. how can i check this. can you please advice me.

p.s.

I love Linux but I’m kind of unskilled/beginner

I did fix a few bugs though :))

Hello,

Do you happen to know how to delete my router details on linux and start again? As in a way that the router could not recognize my device unless I manually take care of that.

We’re having kind of network issues because the router is “confused” because it doesn’t know which Ip address to go to since it has been configurated since the very beginning on two laptops while it actually is alloud on one. SOrry for my bad English. Looking forward for your reply.

Thanks!

Adelina

over all information is good

Could you also go through some commands which show hardware and driver details?

You can use dmidecode command to get hardware information. Here is the article go through it.

Get Hardware Information with Dmidecode Command

I believe the dmidecode is Just what I need. Another of your very useful articles. Thanks.

Hey… can we down the interface using “system-config-network” command?

If yes how?

No, its a GUI-based, so not possible to down interfaces. you can use command line options such as ip command or ifconfig command to down interfaces.

ifconfig is mostly depricated

ip command is the replacement

but overall article was good

ifconfig, route, and netstat are deprecated so you might want to rewrite your howto substituting ip and ss

Sorry, but according to this post https://dougvitale.wordpress.com/2011/12/21/deprecated-linux-networking-commands-and-their-replacements/ many of the commands you’ve listed here are deprecated.

Hasn’t ifconfig been deprecated and replaced by the ip command?

Yes! but still most of the Linux OS comes with ifconfig command and it is still used by many users..

good

Informative article, Thank you.